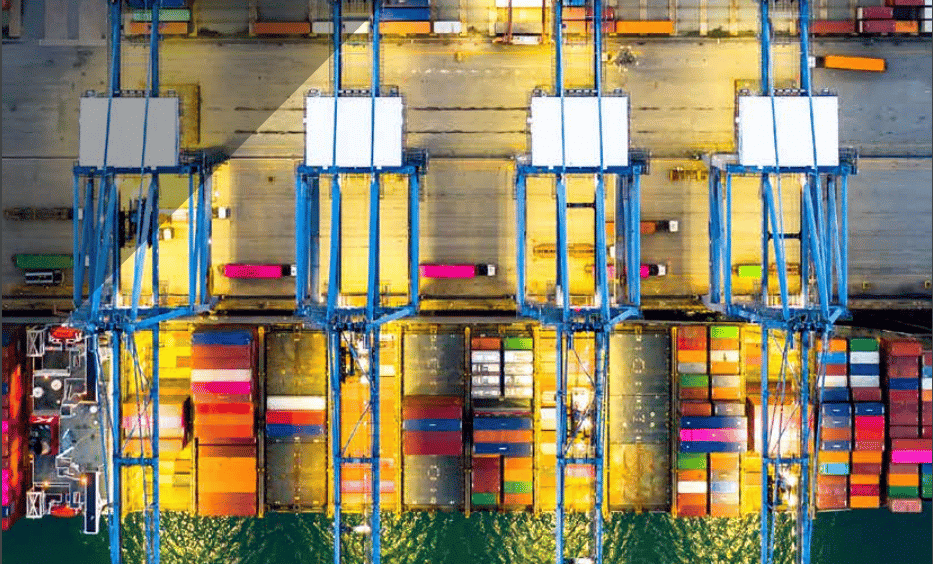

International mobility

Select expertise

International companies today manage a growing number of mobile employees. In addition to the human aspects, this international mobility brings significant financial challenges, not only for employers, but also for employees. Managing these issues related to expats is not an easy task. That's why we help you navigate the numerous legal labyrinths to optimize costs and reduce risks for your company and your employees.

Do you work in an administrative, financial or human resources department?

We will assist you in diagnosing the company’s international mobility needs, developing the company’s international mobility policy, and documenting and implementing the international mobility policy. We assist you in determining the social security tax status of employees, choosing the optimal status depending on the country, eligibility for the impatriation scheme, analyzing the impact of employee relocation, calculating equivalent net salaries, comparing schemes and social benefits, structuring expatriation and impatriation packages, assisting in the recruitment of non-EU nationals, implementing the impatriation scheme and the scheme for exemption from compulsory membership in the French basic and supplementary pension insurance. Finally, we are also available to assist you in the context of tax audits and litigation.

Are you yourself a cross-border expatriate or an expatriate?

We offer you a diagnosis of your personal and professional situation in terms of tax and social security, the determination of the best exit or entry strategy and its implementation, personal tax returns, assistance in completing immigration formalities, support in personal tax audits and litigation, and the accompaniment service within the framework of Family Solutions.

Do you work in a subsidiary of a foreign group?

We will assist you in the risk diagnosis of foreign mobility in connection with the development of the work environment, as well as in the protection of employees in the area of social security and personal taxation.

Publications

Find all our analyses, our points of view and our publications on all issues related to the life of the company.